Released on April 30, 2014

As another tax season comes to a close, the Government of Saskatchewan remains committed to controlling spending and keeping taxes low.

“Since 2007, our government has delivered the largest income tax cuts and the largest education property tax cuts in Saskatchewan history,” Finance Minister Ken Krawetz said. “Lower taxes are a big part of our government’s Plan for Growth and are helping to keep life affordable for Saskatchewan people.”

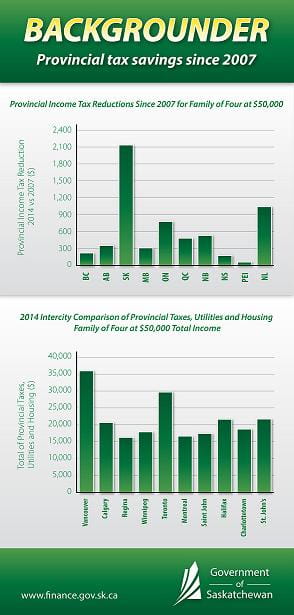

A Saskatchewan family of four with $50,000 in annual income will pay just $166 in provincial income tax in 2014, compared to $2,302 in 2007, representing tax savings of $2,136 annually. In terms of all provincial taxes, that same family will pay $608 in Saskatchewan in 2014, compared to $3,032 in Manitoba, $4,231 in British Columbia and $1,282 in Quebec.

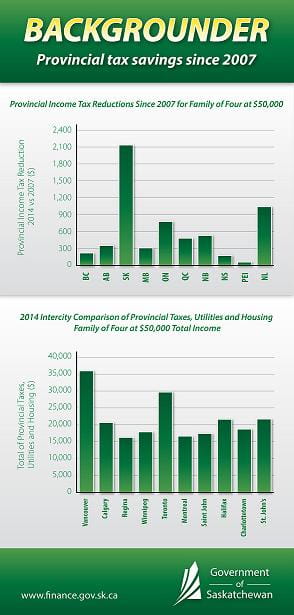

A Saskatchewan family of four or more with an income of $75,000 is once again expected to pay less in total provincial taxes and utilities in 2014 than their counterparts in any other province in Canada.

“Ensuring Saskatchewan people keep more of what they earn through lower taxes helps keep Saskatchewan on the path of steady growth,” Krawetz said. “Even when faced with revenue challenges, keeping taxes low will always be a priority for our government. That’s why the 2014-15 Budget contained no tax increases. Our preference continues to be to balance the budget by controlling spending.”

-30-

For more information, contact:

Brian Miller

Finance

Regina

Phone: 306-787-6605

Email: brian.miller@gov.sk.ca