Borrowing Strategy

Saskatchewan’s public borrowing program has primarily been concentrated in the Canadian domestic market and is expected to remain so going forward. In recent years, however, the Province has expanded its issuance in international markets, with an objective of maintaining approximately 25% of total outstanding debt from international issuance.

Domestic borrowing is focused on 10- and 30-year terms. The Province’s longer maturity profile reflects the fact that the debt is primarily supporting investment in longer term capital assets by both Executive Government and Crown Corporations. The average term of debt has decreased over the last five years due to increased international issuances with shorter maturities.

Depending on borrowing requirements, the Province would look to issue in the USD and/or EUR market every 12-18 months to maintain a consistent presence. Issuance in other currencies will still be contemplated, but would likely be smaller deal sizes, issued opportunistically, and likely with longer tenors.

The Province’s standard practice is to fully hedge internationally issued bonds into fixed-rate Canadian dollar liabilities through the use of derivative instruments.

The Province maintains a target cash balance of approximately $1.5 billion. Additional sources of liquidity include authorization to issue short-term notes of up to $4.0 billion, as well as access to a $3.3 billion government bond fund, which could be liquidated if primary debt markets become challenging.

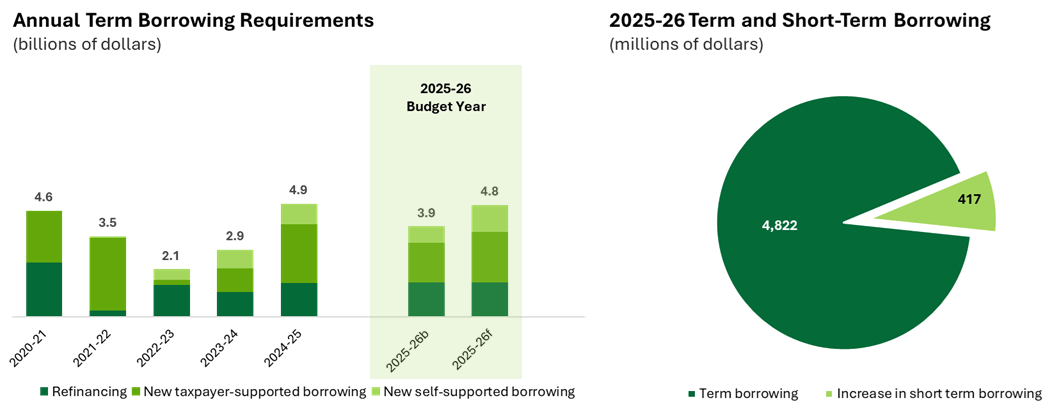

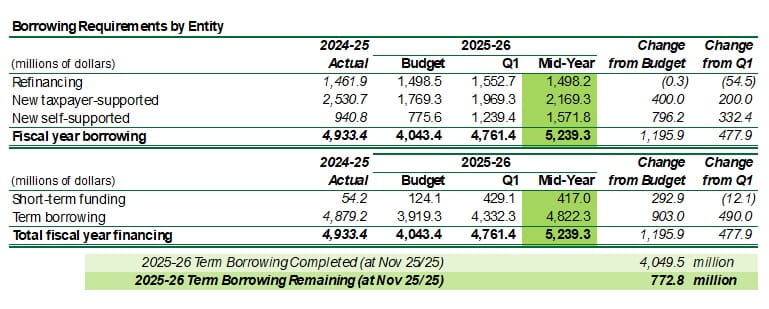

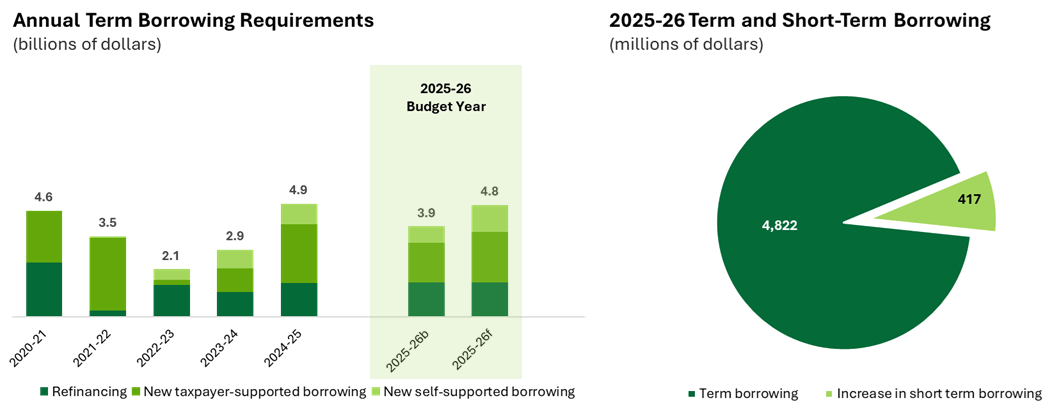

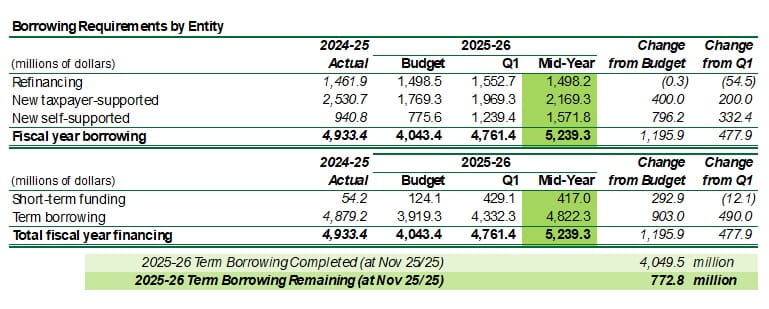

Borrowing Plan

Euro Medium Term Notes Programme (EMTN)

Press release - €1.00 Billion Benchmark Issuance (September 24, 2035)

Press release - €1.25 Billion Benchmark Issuance (May 8, 2034)

Saskatchewan Offering Circular

Debt Issuance Documents

Recent Term Debt Issuances

Term Debt Outstanding as of March 31, 2025

Regulatory Filings and Listings

Provided for your convenience are the following links to the Province of Saskatchewan’s information made available on external sites: