Saskatchewan's agriculture industry and the risks producers face have changed significantly since the Saskatchewan Crop Insurance Corporation's (SCIC) inception. Recognizing these changes, SCIC offers more than what is in its name. SCIC offers a full suite of Business Risk Management Programs that aim to give producers control over managing their risks and ensure they can navigate the challenges of modern farming.

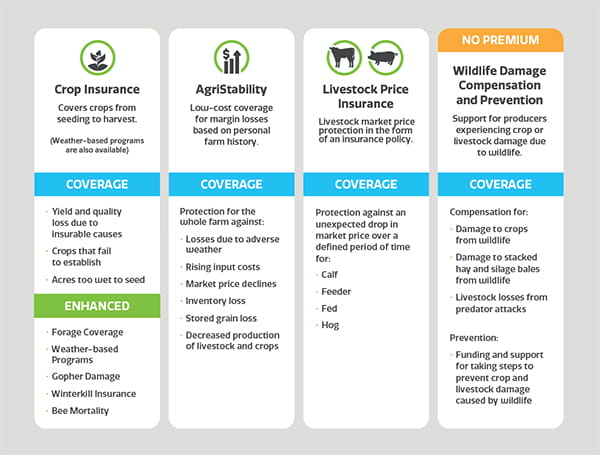

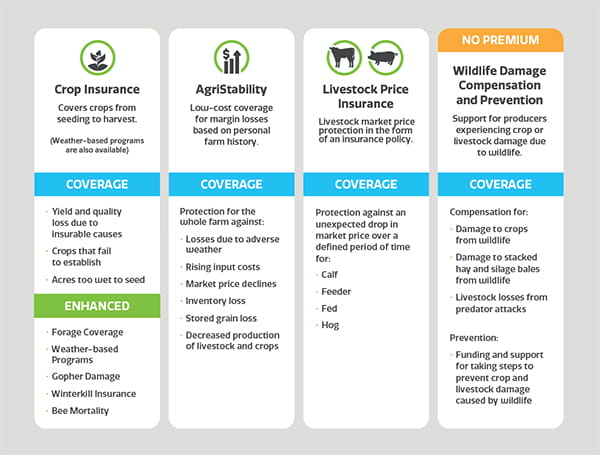

As part of that full suite, SCIC offers the Crop Insurance Program, AgriStability, Livestock Price Insurance and the Wildlife Damage Compensation and Prevention Program.

Crop Insurance

SCIC's most widely used program is the Crop Insurance Program. It provides coverage for crops that experience a loss in yield due to an insurable cause of loss in the quality or quantity of the crop. Within the features of this Program, customers can access coverage options to meet the needs of their operations.

Options include multi-peril coverage, which protects against risks that impact producers' yields, including weather-related events, pests and diseases. The Establishment Benefit protects crops that fail to establish adequately, while Unseeded Acreage protects acres that are too wet to seed due to excess spring moisture. Yield cushioning limits the impact on a producer’s individual yield coverage in poor crop years. When two low yields occur in consecutive years, the amount the yield coverage drops are cushioned in the second year.

Other tools for producers to further their Crop Insurance include selecting different coverage levels (50, 60, 70 and 80 per cent) and utilizing the Crop Averaging option to insure multiple crops together, potentially achieving higher overall coverage. SCIC also offers various price options, including base, low-price, contract price and in-season price options. These options allow producers to tailor Crop Insurance to meet their needs, regardless of their risk.

AgriStability

AgriStability is designed to protect producers against large declines in their income. It covers margin declines caused by any combination of production losses, adverse market conditions or increased costs. Producers enrolled in AgriStability can receive compensation of 80 cents per dollar should their margin decline by 30 per cent. Coverage is personalized for each operation by using historical information based on income tax and supplementary information. This program protects a producer's income in case of a difficult year.

Like insurance for your house or car, producers sign up for AgriStability before something goes wrong. By enrolling before the production year begins, producers can go about their regular business, knowing AgriStability will help if the unexpected happens.

AgriStability considers both crop and livestock operations. The Program provides coverage for losses that can impact an operation's overall financial health, such as those resulting from adverse weather conditions, declining commodity markets, increased input costs, production losses or inventory losses.

AgriStability acts as a safety net. While producers cannot control their risks, they can manage it with AgriStability.

Livestock Price Insurance

Livestock Price Insurance (LPI) is a risk management program where producers can purchase price insurance options for their calves, fed cattle, feeder cattle and hogs. This protection is in the form of an insurance policy and protects against unexpected price drops.

LPI allows producers to establish a floor price (minimum price) for their livestock. In the final four weeks of the policy, if the market falls below the floor price, LPI will pay the difference. If the market is above the floor price, producers can benefit by selling livestock in the higher market.

LPI is designed to be market-driven to reflect the risks these producers face, including price, currency and basis.

This protection against unknown market fluctuations means producers are guaranteed a certain income level, no matter what the market does. This allows producers to manage their risk from volatile market prices effectively.;

Wildlife Damage Compensation and Prevention Program

Wildlife damage can be a significant challenge for agriculture producers. Saskatchewan producers may be eligible to receive funding for both preventive measures and wildlife damage.

In case of damage to crops and stacked forage from wildlife, SCIC has producers covered with Crop Damage Compensation. Farmers and ranchers can also receive Predation Compensation for injury or death to eligible livestock, fowl or specialty animals by predators.

Producers also have the option to receive funding to prevent damage. Producers can be proactive, as funding is available for prevention measures to limit or reduce wildlife damage to crops, feed supplies and livestock. Producers do not need to be existing SCIC customers to access the Wildlife Damage Compensation and Prevention Program.

Flexibility and Control

SCIC offers options for producers to mix and match to meet their needs. This flexibility gives producers a way to manage uncontrollable risks. Knowing their investment is protected can give producers peace of mind. Producers are encouraged to contact their local SCIC office or call toll-free 1-888-935-0000 to discuss the options and coverage that best fit their operation. By leveraging SCIC's programs, producers can effectively manage their various risks, ensuring stability even in the face of adversity.